Executive Director Evaluation, Non-Profit

$139.00

SKU

ED-001

Category Resource Guides

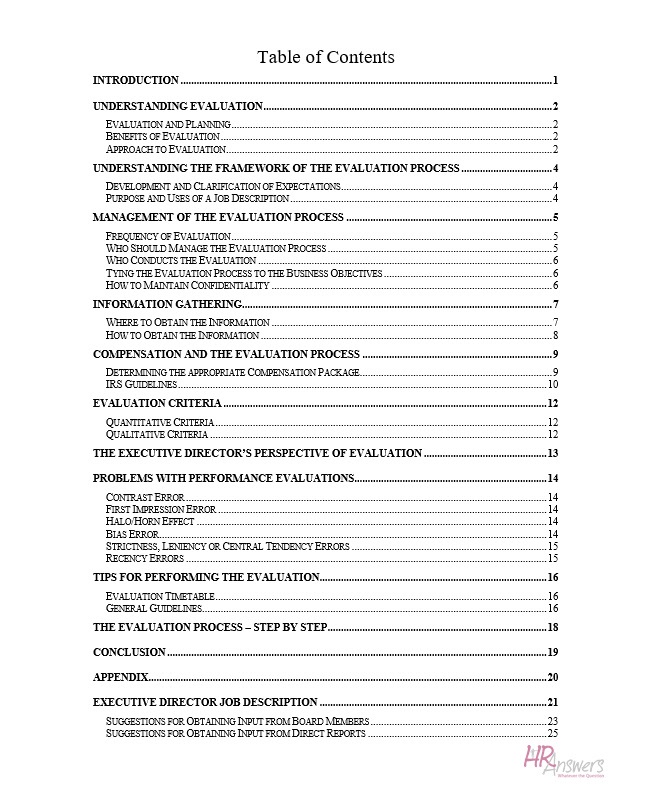

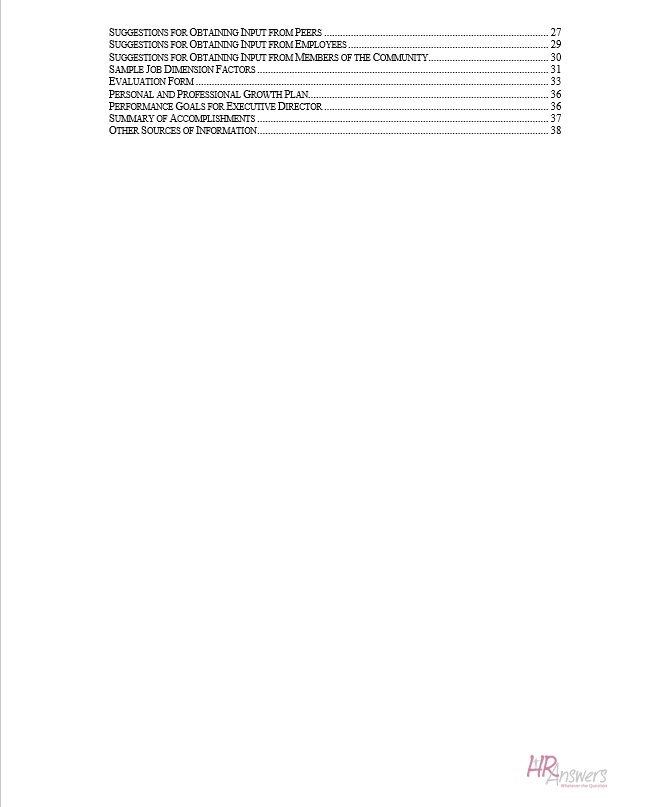

Designed specifically for not-for-profit organizations, this resource guide outlines the steps a Board can take to measure and recognize the Executive Director’s performance. Sample forms are included.